Dr. Kendra Seaman, assistant professor of psychology

Understanding the psychological mechanisms that lead some older adults to make riskier financial decisions than younger adults underlies a UT Dallas researcher’s investigations, funded by a $560,000 grant from the National Science Foundation.

“I’m interested in the shifts that happen in terms of motivation and how that influences decision making,” said Dr. Kendra Seaman, assistant professor of psychology in the School of Behavioral and Brain Sciences. “We hope to understand which older adults are most vulnerable to making poor decisions, why they are more vulnerable and how we can intervene.”

Each year more than 5% of older Americans are victims of financial fraud, estimated to be as high as $36 billion.

The reasons why older adults might make poor decisions are often attributed to cognitive decline or misunderstanding of technology. Seaman, who is the principal investigator for the Aging Well Lab in the Center for Vital Longevity, suspects that changes in decision-making capabilities over time also reflect evolving priorities of older adults based on life experiences.

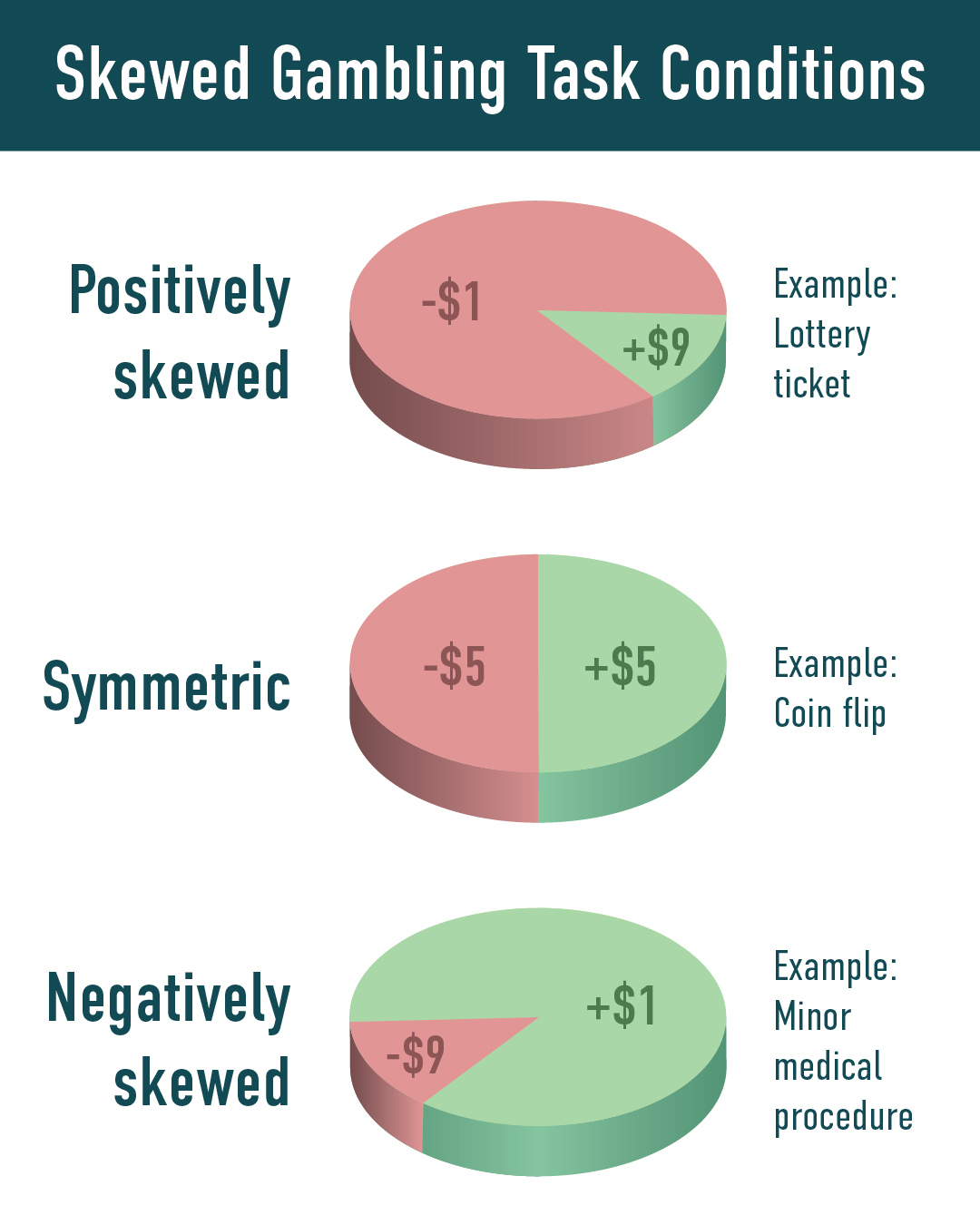

One situation in which older adults seem more susceptible to financial fraud involves positively skewed risks: decisions involving options that juxtapose large but unlikely gains against small, likely losses. This is a scenario presented by many financial scams.

“When there’s a small chance of something big happening, like winning the lottery, people in general are drawn in – older adults even more so,” she said. “My research is trying to figure out why.”

– Stephen Fontenot